After years of quiet evolution, artificial intelligence (AI) is now driving innovation in all industries at an unprecedented speed. Even the finance industry, a highly regulated sector that was initially slower to adopt the new technology, is beginning to use AI for analysis and forecasting, fraud detection and prevention, personal finance management, compliance-related tasks, and customer service and support.

As recently as 2021, financial institutions were considered relatively immature in terms of AI deployment compared to other industries, and were projected to lag for the foreseeable future due to regulatory concerns, a lack of AI infrastructure, and a dearth of AI-trained workers.

But the rise of large language models (LLMs) and generative AI (Gen AI) at the beginning of 2023 sparked a change. According to forecasts by technology market research firm IDC, worldwide spending on AI hardware and services is set to exceed $500 billion by 2027, and financial service organizations are expected to double their AI spending during that time, reports the International Monetary Fund. That's understandable, considering AI's potential to reduce human error, predict market trends, speed document analysis, and churn through huge datasets.

_(1)_1732603719.jpeg)

How Is Artificial Intelligence Changing the Finance Sector?

Companies are embracing the abilities of AI and LLMs to simplify and speed up data-heavy tasks, pinpoint fraud, and improve customer service. Despite the slow start, it's easy to see why the finance industry and finance teams within companies are accelerating their adoption of the technology.

In 2023, BlackRock integrated AI across various facets of its operations to enhance investment strategies, improve client outcomes, and drive innovation. However, some investment firms have resisted AI due to the need to update legacy systems, the challenges of integrating the technology into existing financial models, and other potential risks.

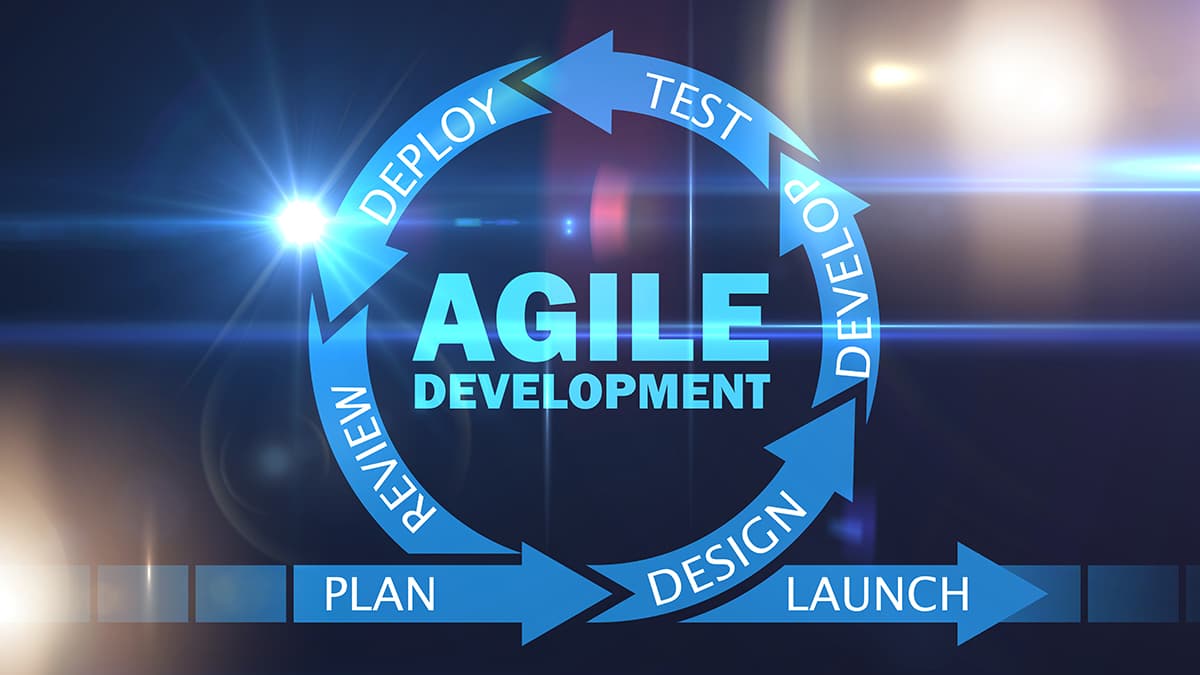

_1732603697.jpeg)

Four Specific Areas Where AI in Finance Can Deliver Impact

Parsing Data

The most obvious benefit that AI offers to finance is its facility for reading, classifying, and extracting insights from datasets too large and complex for humans to manage effectively. Companies usually collect massive amounts of information, even though more than two-thirds may never be used.

JPMorganChase's contract intelligence platform called COIN exemplifies this capability. Utilizing natural language processing (NLP), COIN extracts and analyzes key information from loan documents automatically. The implementation dramatically reduced the time required to review documents from 360,000 hours annually to just seconds, with fewer errors.

Optimizing Portfolios With Precision

Using AI, companies can tap into previously underutilized data in real time, greatly enhancing their ability to respond to changes in financial markets. Renaissance Technologies' Medallion fund demonstrated this potential early, achieving a 63.3% return from 1998 to 2018 through sophisticated algorithms.

BlackRock uses specialized LLMs trained on narrower datasets specifically tailored for precise investment tasks, such as analyzing trends from earnings calls and predicting subsequent market movements. The benefit of narrower datasets is that they typically contain less irrelevant data, minimizing the likelihood of the model being influenced by extraneous factors and thereby reducing noise and potential errors.

Supporting Compliance Tasks

As financial services become more complex, the tools firms use to support regulatory compliance must keep up. HSBC partnered with AI firms to better detect potentially suspicious financial transactions and flag them for investigation. The company credits AI adoption with a 20% reduction in needed investigations, allowing compliance officers to focus more on high-risk cases while lowering false positive rates in transaction monitoring.

Using Robots in Customer Service

LLM-driven chatbots and virtual assistants are transforming customer service by using deep learning to autonomously manage routine inquiries and transactions. Bank of America's chatbot, Erica, launched in 2018, provides functionalities like predictive insights, proactive alerts, enhanced fraud detection, and personalized financial planning. By 2023, clients engaged with Erica 56 million times monthly. According to a survey by Salesforce, 81% of banking customers now try to solve problems themselves with tools like chatbots before requesting human intervention.

_1732603743.jpeg)

Challenges and Future Outlook

The primary challenges facing AI adoption in finance include:

• Data Security: Financial companies must protect vast amounts of sensitive information against breaches and unauthorized access while complying with regulations like GDPR and CCPA. Penalties for violations can reach €20 million or 4% of global annual revenue under GDPR.

• Data Quality: AI models require clean, accurate, and complete data to function effectively. Maintaining high-quality data requires continuous updating and refinement of algorithms based on new information.

• Talent Shortage: According to Rackspace Technologies, two-thirds of IT leaders cite the shortage of skilled AI talent as their main roadblock. A Harvard Business School study found that AI can improve work quality by up to 40%—but only with highly skilled people working on appropriate tasks.

• Implementation Costs: Training large AI models can cost millions of dollars, limiting sophisticated AI deployment primarily to large institutions. Many financial institutions also operate on legacy IT infrastructures not designed to support the latest AI technologies.

As artificial intelligence rapidly evolves, financial organizations must embrace continuous innovation and adaptability to stay ahead. This includes investing in ongoing staff training, updating systems regularly, and experimenting with new AI applications. Collaboration between banks, fintech companies, regulators, and technology providers will be crucial in addressing common challenges and establishing industry-wide standards for ethical AI implementation in financial services.

At CSM Tech, we work with enterprises in the BFSI space to help optimize their day-to-day operations and turbocharge their productivity through application of emerging technologies. Talk to us about your challenges today: www.csm.tech/americas/contact-us

Want to start a project?

Get your Free ConsultationOur Recent Blog Posts

© 2026 CSM Tech Americas All Rights Reserved