Coal remains India’s most vital energy source, fuelling more than 70% of electricity generation and acting as a backbone for steel, cement, and heavy industries. With the Government of India’s ambitious roadmap to reach 1.5 billion tonnes of coal production by FY 2030 as per Ministry of Coal, the sector is poised for expansion. The recent waves of commercial coal auctions are a testimony to this momentum, drawing private players into what was once a state-dominated space.

But as production scales, one challenge looms larger than ever: transportation bottlenecks. Extracting coal is only half the job; moving it efficiently from pit to power plant is what decides whether India can sustain its industrial growth. From clogged stockyards and unmonitored weighbridges to route diversions and truck delays, inefficiencies in logistics often wipe out the very gains made in mining.

The Complex Journey of Coal

Coal logistics is not a simple pit-to-port story. It involves multiple stages which includes mine dispatch, weighbridge clearance, stockyard stacking, road and rail connectivity, and last-mile delivery. Each stage has its own vulnerabilities:

- At the pithead, delays in dispatch planning lead to idle fleets and wasted production hours.

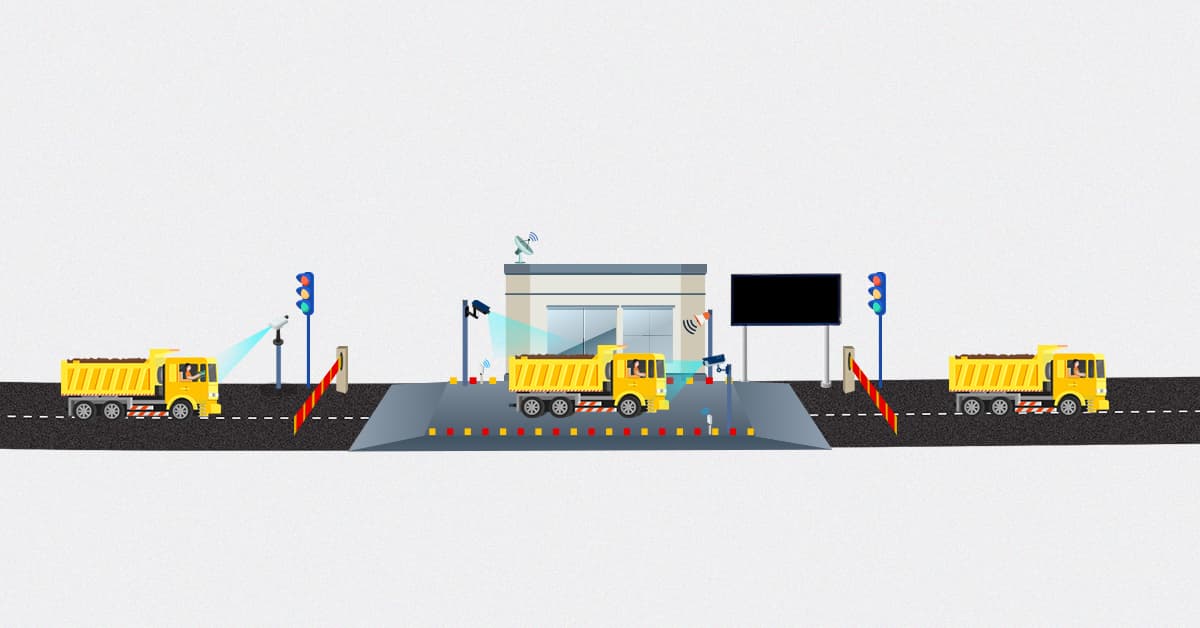

- At weighbridges, manual intervention creates room for pilferage, under-invoicing, and disputes.

- In stockyards, mismanaged stacking causes losses in both quantity and quality of coal.

- On the road, lack of route monitoring results in diversion, excess fuel consumption, and safety risks.

According to a NITI Aayog report (2023), logistics costs in India stand at 13–14% of GDP, significantly higher than the global average of 8–10%. In coal, this gap is even more pronounced due to outdated processes and the sheer scale of movement, over 800 million tonnes annually by road and rail.

The Policy Push for Smarter Coal Movement

Recognising this, policymakers have turned their attention to the logistics backbone of mining. The Ministry of Coal has announced measures to expand first-mile connectivity through conveyor belts, mechanised loading systems, and digital tracking, targeting an investment of ₹50,000 crore by 2030. The goal is clear: to eliminate bottlenecks that slow down supply chains and to create a transparent, tech-driven ecosystem that aligns with India’s decarbonisation goals.

This shift also matches global energy transitions. While coal continues to be central to India’s energy security, there is increasing scrutiny on its efficiency and sustainability. Better logistics not only reduces wastage but also lowers the sector’s carbon footprint, making it a key enabler of a balanced energy future.

The Digital Makeover of Coal Logistics

In this context, digital solutions are not optional, they are inevitable. Mining companies and coal PSUs are increasingly investing in technologies that replace manual operations with real-time intelligence.

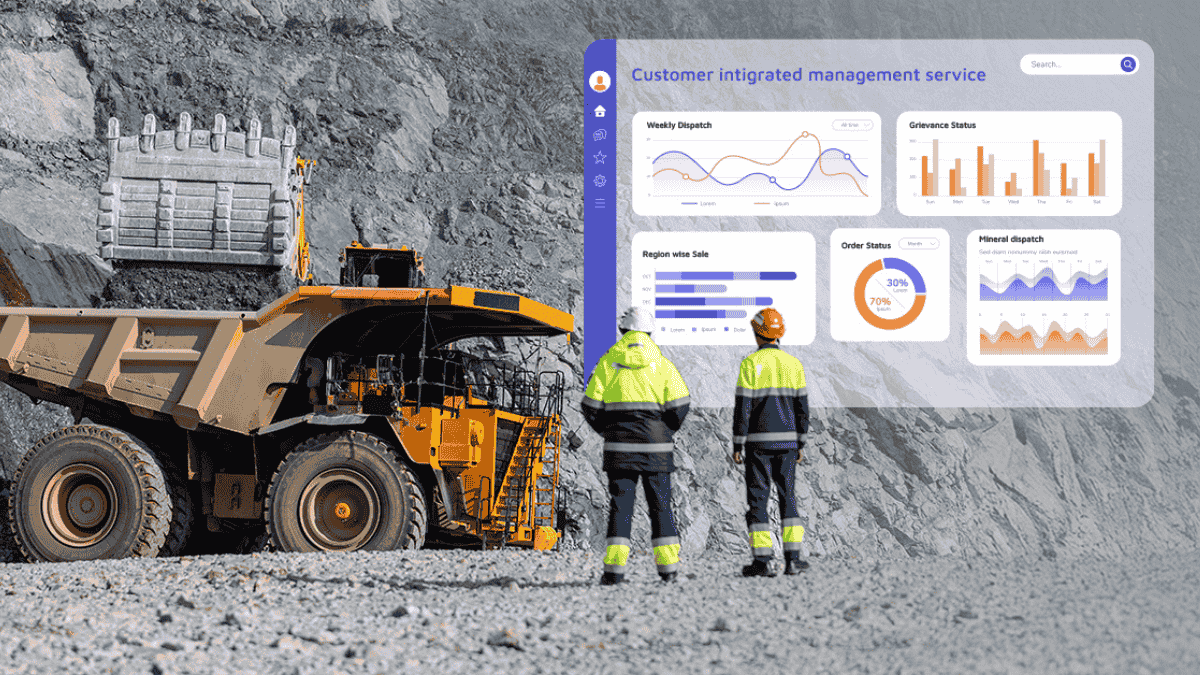

Take, for example, the Digital Logistics Management System (DLMS). Instead of ad-hoc truck assignments, DLMS enables automated dispatch planning, GPS-based route optimisation, and seamless ERP integration with e-waybills and permits. For JSW, this has meant an 81% reduction in truck turnaround time and a 20% rise in productivity, a real-world proof of how automation directly improves throughput.

Similarly, weighbridge automation is addressing one of the most sensitive points in the chain. Traditionally, weighbridges have been hotspots for manipulation, disputes, and leakages. By deploying AI and RPA-driven unmanned weighbridge system, companies can now capture weight in real time, generate tamper-proof e-transit passes, and ensure absolute transparency in movement.

Stockyards, often seen as “black holes” where coal gets mismanaged, are also undergoing a transformation. By integrating RFID checkpoints, CCTV surveillance, boom barriers, and ERP-linked tracking, miners are achieving grievance-free stack movements, reduced diversions, and tighter compliance. At OMC, for instance, this has resulted in far smoother dispatch flows across multiple yards.

Looking Ahead: The Future of Coal Transport

The future of coal logistics in India is likely to be defined by three broad trends:

- End-to-End Digital Integration – Every stage of movement, from pithead dispatch to final delivery, will be digitally mapped. Dashboards offering real-time visibility to mine operators, regulators, and customers will become standard.

- Shift Towards Multi-Modal Transport – With rail and waterways gaining policy support, coal will increasingly move beyond trucks. Seamless digital coordination across modes will be critical to efficiency.

- Data as a Decision-Maker – Predictive analytics, AI, and IoT-enabled monitoring will shift coal logistics from reactive problem-solving to proactive planning to ensure fleets, yards, and routes are optimised well in advance.

Together, these shifts will not just make coal supply chains more efficient, but also more accountable, sustainable, and aligned with the government’s growth targets.

A Defining Moment for Indian Coal

India’s coal sector stands at a defining juncture. Auctions have opened new opportunities, production targets are ambitious, and demand continues to surge. Yet, unless the logistics puzzle is solved, the country risks slowing down its energy ambitions.

Digital solutions hold the key. From the mines of Odisha and Chhattisgarh to the stockyards feeding plants not only in Odisha, Chhattisgarh, Jharkhand but in Tamul Nadu and Karnataka, technology is already proving that bottlenecks can be eliminated and transparency can become the norm. What is needed now is rapid adoption, scaling, and a mindset shift, from seeing logistics as a support function to recognising it as the true enabler of coal’s future.

We will verify and publish your comment soon.